Preparing Future Legal Professionals to Combat Global Money Laundering

Jakarta, 16 September – Money laundering is a serious financial crime that poses significantly risks to the stability of the global economy. The United Nations Office on Drugs and Crime (UNODC) estimates that between 2-5% of global Gross Domestic Product (GDP), equivalent to USD 800 billion to 2 trillion, is laundered every year. To address this challenge and broaden awareness, our Business Law program invited Dr. Ilaria Zavoli, an International Criminal Law expert who is also co-Director and Lecturer at School of Law, University of Leeds, to share her knowledge and experience with our students, faculty, and staff at our Kijang campus.

(Photo Credit: Mufti Warits)

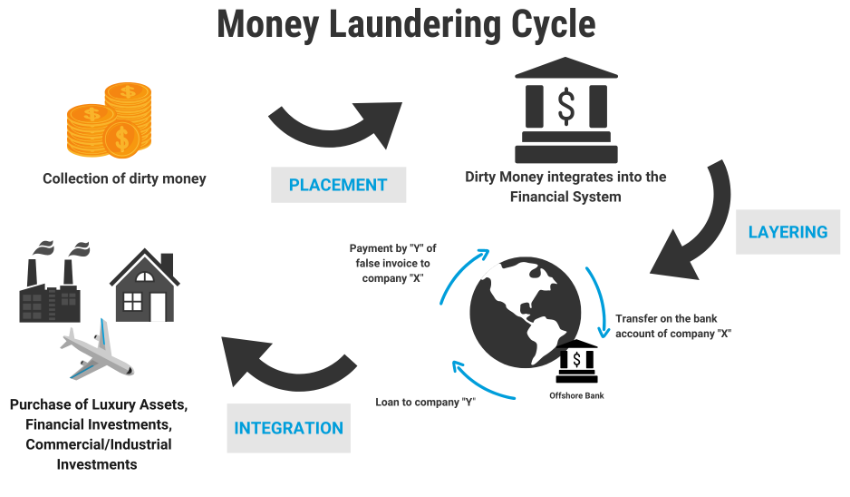

As a prominent researcher and law practitioner based in the United Kingdom and Italy, Dr. Ilaria has long been active in studying and combating money laundering. To ground this in international law, she referred to the UN Vienna 1988 Convention, Art. 3.1, which explicitly defines the act as the conversion or transfer of property derived from criminal activity for the purpose of concealing its origin or aiding offenders in evading legal consequences, as illustrated in the figure of the Money Laundering Cycle below.

During her lecture, she emphasized to students that at its core, money laundering involves the transformation of illicit funds (“dirty” money) into legitimate assets (“clean” money).

(Source: UNODC Romena)

“Major driving force behind illegal activities, from bribery and corruption to trafficking and fraud, is profit. Criminals then seek to legitimize their illicit proceeds through money laundering, often channeling funds into sectors such as real estate, cryptocurrencies, construction, and insolvency. In the UK, this activity is estimated to cost £30–90 to £100 billion annually,” said Dr. Ilaria, citing Transparency International’s report.

(Photo Credit: Mufti Warits)

In Indonesia, similar concerns persist. Money laundering cases have been linked to major scandals involving public figures, corporations, and transnational networks by disguising the origins of funds from corruption, narcotics trafficking, or embezzlement, offenders integrate “cleaned” money into the economy.

According to Yoserwan (2024), Indonesia lost more than IDR 140 trillion in 2022 due to corruption in that year alone. Such staggering figures underline the urgency of enforcing anti-money laundering legislation under Law No. 8 of 2010 more rigorously, starting from the stages of investigation and prosecution through to the trial process, in order to minimizing long-term state losses, rebuilding public trust, and safeguarding economic integrity.

(Photo Credit: Mufti Warits)

By providing our Business Law students with a comprehensive understanding of global and national money laundering practices, we equip them with the analytical skills and critical awareness needed to promote transparency and accountability in their future careers while navigating complex legal and business environments. In line with the university’s vision of fostering and empowering society to build the nation, the opportunity to exchange insights with international experts prepares our students to uphold integrity, ensure compliance, and contribute to ethical practices that strengthen the nation’s economic and social systems.

(Words by: Mita Adhisti/Editor: Hamzah Ramadhan)

Comments :